NOTE: The EUTF Open Enrollment and Island Flex forms are not applicable to RCUH employees.

RCUH’s Open Enrollment is Now Live!

The RCUH annual benefit Open Enrollment (OE) election period is an opportunity for active benefits-eligible employees (i.e., Regular Status – including relief and non-regulars, 50% FTE or more) to elect, waive, or change certain benefit elections for the upcoming plan year. Mid-year enrollments and changes to health insurance (medical and dental) and Flexible Spending Accounts (FSA) for healthcare and dependent care accounts are not allowable, unless you experience a qualifying life event or family status change event.

This year’s annual benefit Open Enrollment election period will be April 24-May 17, 2024.

OE elections will be effective July 1, 2024.

For Plan Year: July 1, 2024 – June 30, 2025.

ACTION NEEDED: Unlike previous years, we are requiring all benefits-eligible employees to complete the new electronic RCUH Open Enrollment form to confirm their elections for the new plan year. Please access via RCUH Employee Self-Service > Benefits > Open Enrollment. The Open Enrollment form is accessed from a different location from eUpload. Please do not submit open enrollment elections via eUpload. All other benefit change requests may still be submitted via eUpload.

RELEVANT DOCUMENTS:

Required Supporting Documents

| Action | Required Supporting Documents (If document is not in English, please also include translation) |

|---|---|

| Enroll/Make changes for Self | N/A |

| Add a Spouse | Marriage Certificate |

| Add a Civil Union Partner | Civil Union Certificate |

| Add a Domestic Partner | - Notarized Declaration Domestic Partnership (Form B-14) - Affidavit of Dependency for Tax Purposes (Form B-16) - Notarized only if individual is a tax dependent |

| Add a Dependent Child | - Birth Certificate - Guardianship Decree (if legal guardian) - Adoption Decree (if child is placed for adoption or adopted) |

Important Dates

| Plan Year | July 1, 2024 - June 30, 2025 |

|---|---|

| OPEN ENROLLMENT DATES | |

| Open Enrollment Election Period | April 24 - May 17, 2024 |

| Open Enrollment Submission Deadline | May 17, 2024 |

| COVERAGE AND DEDUCTION DATES | |

| Effective Date for Open Enrollment Submission (enrollment and changes) | July 1, 2024 |

| First Premium Deduction for Health Insurance (if enrolled) | June 16-30, 2024 pay period (will be reflected on July 5 pay stub) |

| First Premium Deduction for Flexible Spending Accounts for Healthcare and/or Dependent Care, Supplemental Long-Term Care (if enrolled) | July 1-15, 2024 pay period (will be reflected on July 22 pay stub) |

Tentative Virtual Open Enrollment (OE) Office Hours for any OE questions (Zoom link forthcoming):

- April 24, 2:00 p.m. HST

- May 1, 2:00 p.m. HST

- May 8, 2:00 p.m. HST

- May 15, 2:00 p.m. HST

1. Fully Electronic RCUH OE Form: Starting April 24, 2024, all benefits-eligible employees will see the “Open Enrollment” link in RCUH’s Employee Self-Service under Benefits. The form will show the employee’s current elections or waiver for medical, dental, FSA Healthcare and FSA Dependent care. If eligible (Regular status, 75% FTE or more), the form will show the employee’s current life insurance coverage amount and their life insurance beneficiary(ies) elections. Instructions and screenshots on how to complete the electronic RCUH OE Form will be available in the RCUH Guide to Health and Welfare Benefits.

Reminders:

- Employees who wish to continue to waive medical must submit a new eWaiver for the upcoming plan year. The current eWaiver on file is only valid through June 30, 2024.

- Employees who wish to continue their FSA must re-enroll every plan year. Re-enrollment for FSA in the new plan year is not automatic.

2. RCUH Guide to Health and Welfare Benefits: This document will be available on April 24, 2024 to all active benefits-eligible employees and offers a comprehensive overview of your health and welfare benefit options, including details on eligibility, enrollment, coverage details, and what happens when you are no longer eligible for coverage as an active RCUH employee.

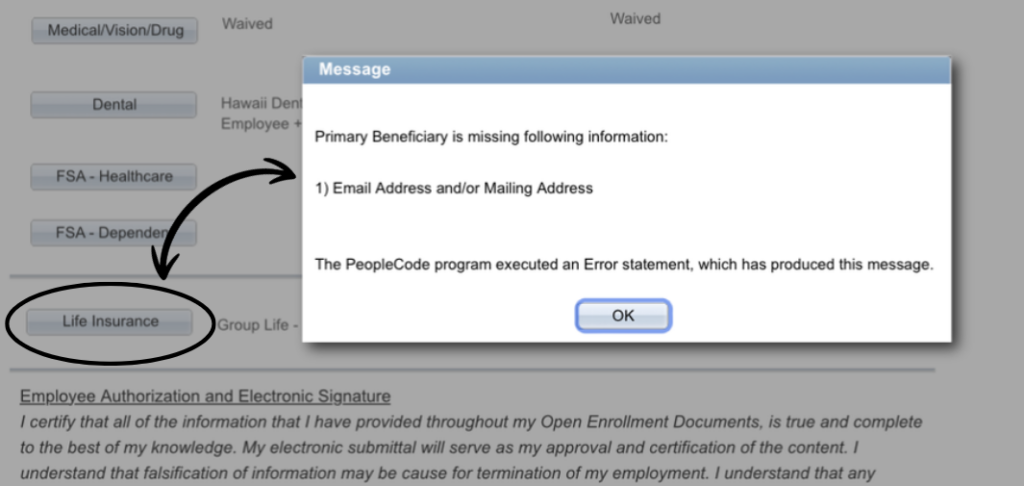

3. Life Insurance Beneficiary(ies) Update: Effective July 1, 2024, the life insurance beneficiary(ies) will be available for eligible employees (Regular status 75% FTE or more) in Employee Self-Service. This will allow employees to assign and confirm their beneficiary(ies) at any time (except during payroll processing blackout periods). Eligible employees will have a preview available on April 24, 2024 (as part of the electronic RCUH OE Form) to update missing information and confirm current elections. The form will require the following information for all beneficiaries:

- Full legal name (First and Last name, or you may name your trust)

- Either a mailing address or email address

- Phone number

IMPORTANT: If you receive an error message to update your Primary Beneficiary Contact Information, click on “Life Insurance” to bring up the Beneficiary Designation Section.

4. Updated IRS Maximum Contribution Limits: There was an increase to the FSA healthcare maximum contribution limit for tax year 2024. No change to FSA dependent care maximum limit from 2023.

| Flexible Spending Account Type | 2024 Maximum Limit | 2023 Maximum Limit |

|---|---|---|

| Healthcare | $3,200 ($133.33 per pay period) | $3,050 |

| Dependent Care | $5,000 ($208.33 per pay period) | $5,000 |

5. Medical Plan Changes: No plan offering changes this year: 4 HMSA medical plans, 2 Kaiser medical plans, 1 HDS dental plan.

- Kaiser changes: Enhanced dependent child coverage while away from Hawai’i and enhanced hearing aid benefit.

- HMSA changes: HMSA essential drug plan for oral chemotherapy

6. Updated RCUH Employee Benefits Spotlight Series: Due to popular demand, the Benefits Spotlight: Flexible Spending Account was updated to help employees better understand the benefit. The PreTax Transportation was separated into a new Benefits Spotlight: PreTax Transportation Benefits Plan: Parking & Transit to help employees understand and distinguish the differences from the other FSA options.

How You Can Prepare for Open Enrollment

1. Check 2FA Setup on RCUH Employee Self-Service: Effective February 23, 2024, RCUH implemented DUO Security as a two-factor authentication (2FA) for Employee Self-Service. Check that you’re able to log into Employee Self-Service and have DUO set up. If you need assistance with 2FA or password reset, please contact [email protected] or call (808) 956-8900.

2. Check Your Current Benefit Elections by logging into RCUH Employee Self-Service > Benefits > Benefit Summary.

3. Gather Contact Information for Life Insurance Beneficiary(ies) (if applicable): Collect the following information: full legal name, mailing address, email address, and phone number.

4. Gather Dependent Information: If you plan to add eligible dependents to your health insurance, start gathering the required documents to show proof of the relationship.

5. Research FSAs: Check out our Benefits Spotlight – Flexible Spending Accounts: Healthcare & Dependent Care and research carefully. Although FSAs can have advantages, it may not be advantageous for everyone. Consult your tax advisor to see how this affects your taxes and determine if this option is beneficial for you and your family. Elections are a total commitment for the entire plan year. No cancellations are allowed and any remaining unused funds will be forfeited at the end of the plan year (June 30th).

Keep in mind, you do not have to wait for Open Enrollment to do the following:

- Voluntarily cancel or drop dependents from health coverage

- Enroll or add eligible dependents to health coverage within 30 days of a qualifying life event (no plan changes allowed)

- Make changes to a Pretax Transportation Benefits Plan for parking or transit accounts

OE Frequently Asked Questions

Q: I received an email from EUTF about Open Enrollment (OE), is this the same thing?

A: The EUTF announcement is not applicable to RCUH employees. All employees with a hawaii.edu email address received this message. RCUH’s annual benefit Open Enrollment period will be from April 24 – May 17, 2024. All changes will be effective July 1, 2024. RCUH's electronic OE Form will available in the RCUH Employee Self-Service on April 24, 2024.

Q: If I’m not making any changes, do I still need to complete the electronic RCUH OE form?

A: Yes. This year RCUH is requiring all benefits-eligible employees to complete the new electronic RCUH OE form to confirm their elections for the new plan year, and to confirm their life insurance beneficiary(ies) (if applicable).

Q: I currently waived medical insurance with RCUH, do I still need to complete the electronic RCUH OE form?

A: Yes. Your current waiver is only good through June 30, 2024, so RCUH will need a new eWaiver, which will be available in the electronic RCUH OE form, for the new plan year of July 1, 2024 – June 30, 2025.

Q: Does my Flexible Spending Account (for Healthcare and/or Dependent Care) automatically renew for the next plan year?

A: No. Re-enrollment is not automatic. If you would like to continue, you must re-enroll on the electronic RCUH OE form. Please do not complete the State of Hawaii Island Flex form. This form is not applicable to RCUH employees and will cause delays.

Q: Are the forms on eUpload the same as the electronic RCUH OE form?

A: No. On April 24, 2024, an Open Enrollment section will be available in Employee Self-Service under Benefits. This is where the electronic RCUH OE Form will be located. If employees submit OE requests via eUpload now, RCUH will reject these submittals and employees will need to re-submit on the electronic RCUH OE Form.

Q: What if I will be on vacation or on leave during April 24, 2024 – May 17, 2024 and will not have computer access during that time to complete my RCUH OE Form?

A: Contact the RCUH Employee Benefits section at [email protected] or call (808) 956-2326 for assistance.

Contact:

Questions regarding employee benefits or Open Enrollment: [email protected] or call (808) 956-2326 or (808) 956-7055.